Horizon

Broaden your actuarial horizons with Horizon

Horizon is a time-saving, process-improving actuarial modeling tool powered by targeted machine learning models. Horizon automates balance sheet construction and capital projection. It works at a policy component level. Hosted on the cloud, Horizon is secure and requires zero upkeep. What’s more, Horizon is seamlessly integrable with Edge.

Horizon for Life products

Stochastic and machine learning-generated modeling that calculates value in force, profit, loss, and reserves development by scenarios and by components. Breaks income down by premiums and reinsurance components; and expenses by payments and commissions components.

Horizon for non-life products

Calculates SCR per each line of business. Breaks down non-life and NSLT health; CAT, lapse, Premium and reserve SCR.

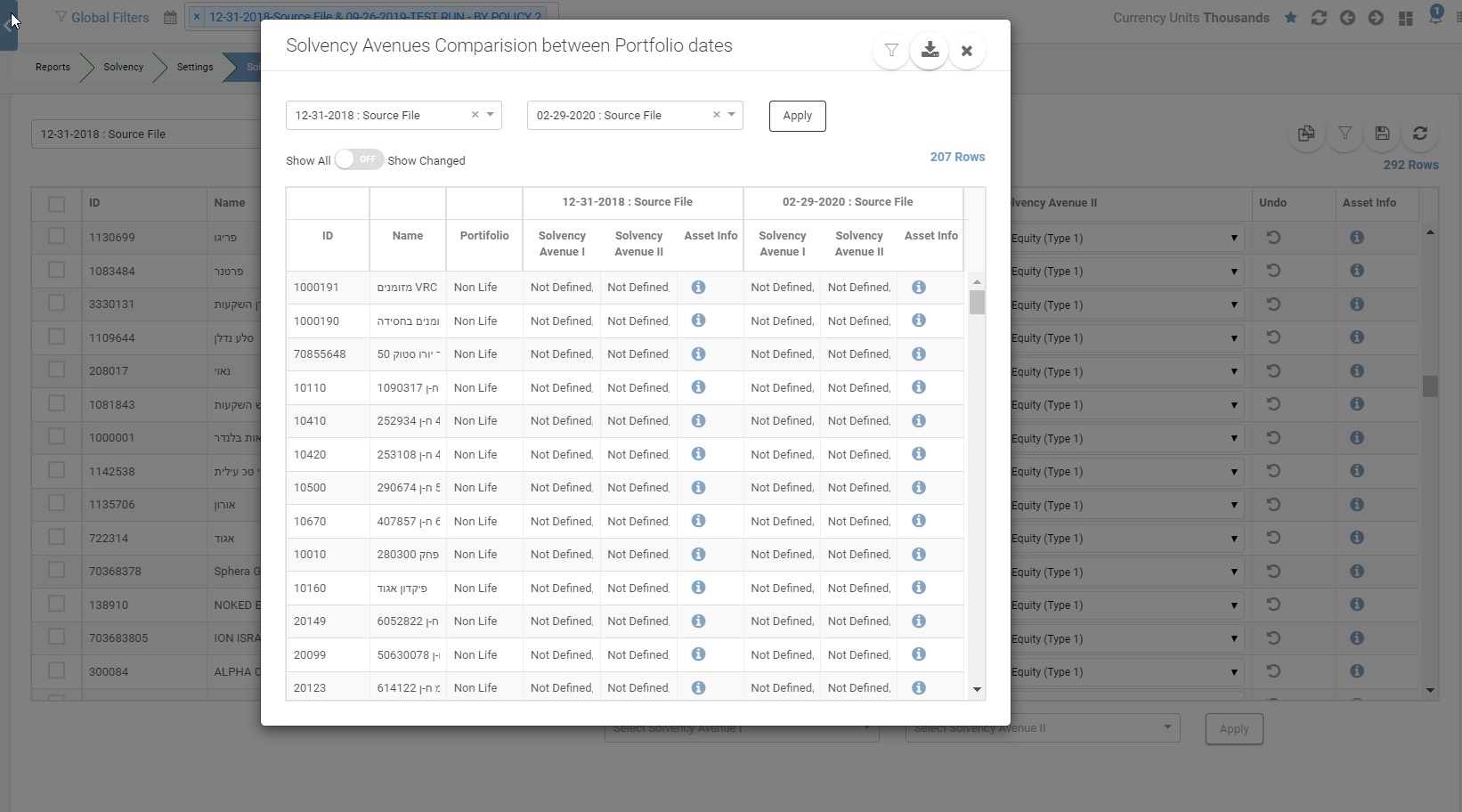

Audit and log

Offers solvency comparison over time. Allows setup of individual assets, and a report log to track portfolio updates.

Actuaries and Solvency

As industry veterans, we’ve heard it many times – actuaries were the first data scientists and insurance companies were the first data companies. Horizon transforms today’s insurers’ “so much data, so little time” dilemma into a “solid insights in no time” success story. It helps generate Solvency II-compliant actuarial modeling at the click of a button.

Regulation Reporting

With bottom-up balance sheet construction, Horizon automatedly fills Solvency and Hepler tabs and generates the SFCR main reporting file for utmost convenience.

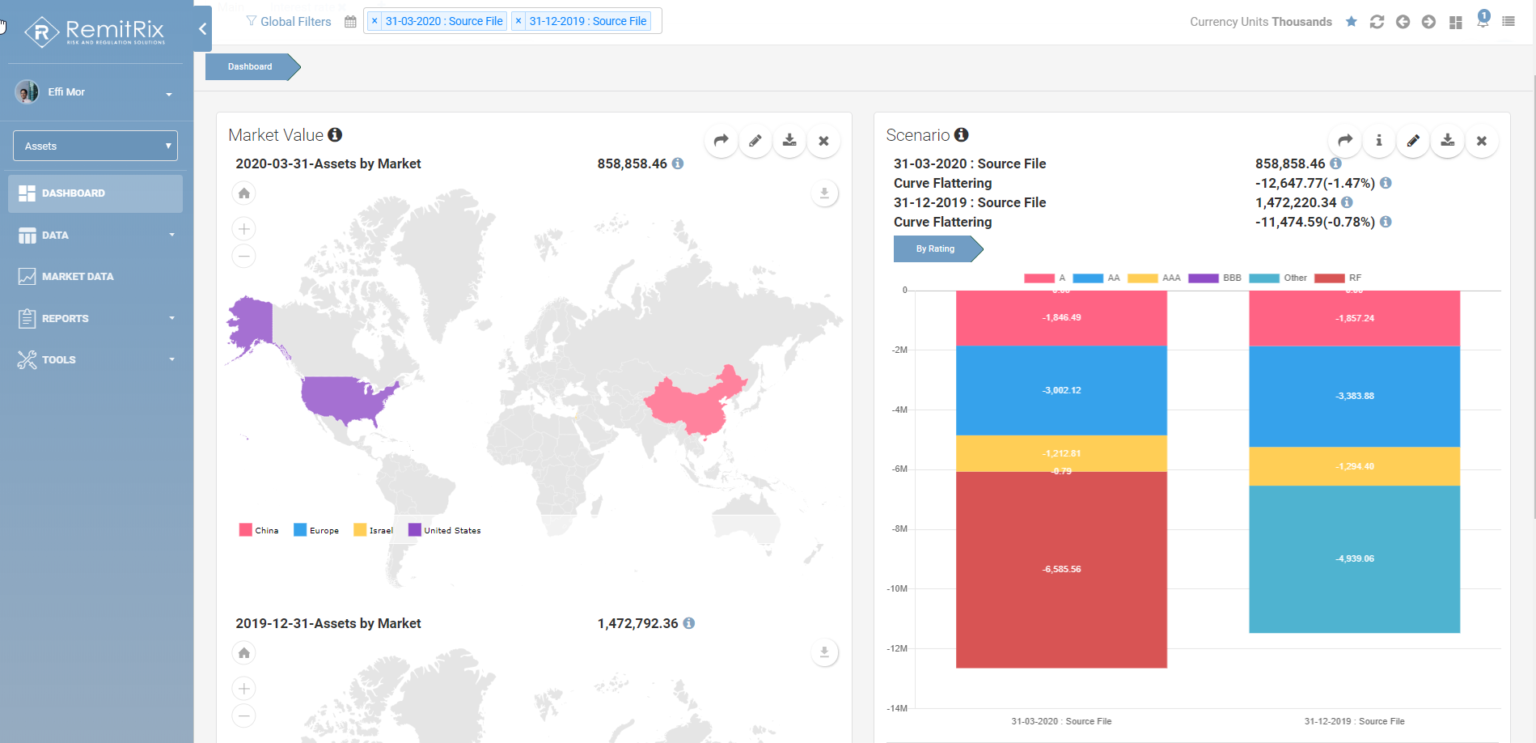

Dashboards

Benefit from intuitive, personalized dashboards with multi-level filters, automated notifications, and drill down reports. Present live interactive reports to an audience, and share your reports with select teammates.

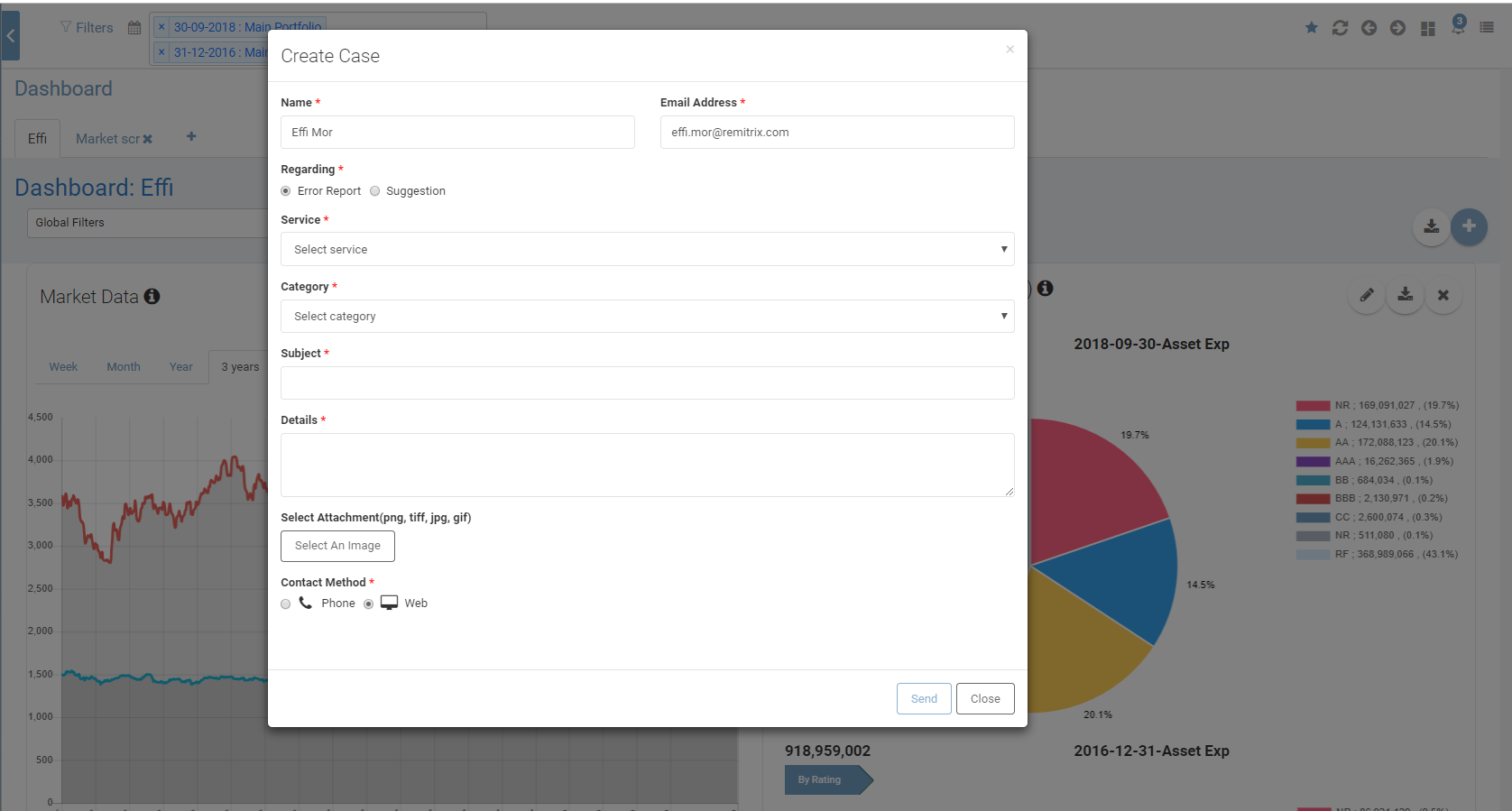

Online Support

The on-demand technical support is offered through an easy-to-use web-based ticketing system.

RemitRix Actuarial Risk Management Module

Dashboards

- Manage risk like a pro!

- Intuitive

- Personalized

- Share your reports with your teammates

- Present live interactive reports

Life products

- Value in Force by scenarios and by components

- Profit and loss by scenarios and by components

- Reserves development

- Incomes breakdown by premiums and reinsurance components

- Expenses breakdown by payments, commissions components

- Capital projection simulator

Non Life products

- SCR calculation per each Line of Business

- Non-Life and NSLT Health breakdown

- CAT, Lapse, Premium and reserve SCR

Regulation reporting

- Balance sheet bottom up construction

- Solvency and Helper tabs automated fill

- SFCR main reporting file

Audit and log

- Solvency comparison over time

- Setup of individual assets

- Log report to track portfolio updates

Flexible and agile front end

- Multi level filters

- Automated notifications

- Drill down report

Parameters

- Control parameters of Standard model

- Compare portfolios before and after model change

Online support

- Online tickets based support service

- Community knowledge center to enrich your profession

- Live chat